Job growth recovered strongly following setbacks caused by severe storms and a significant strike.

Monthly change in jobs

Job creation made a strong recovery in November, bouncing back from the effects of storms and a major strike, and highlighting a trend of modest employment growth over recent months.

According to the Labor Department’s report on Friday, the U.S. economy added 227,000 jobs in November, adjusted for seasonal variations. Revisions to the figures for September and October brought the three-month average gain to 173,000 jobs, slightly outpacing the average growth from the preceding six months.

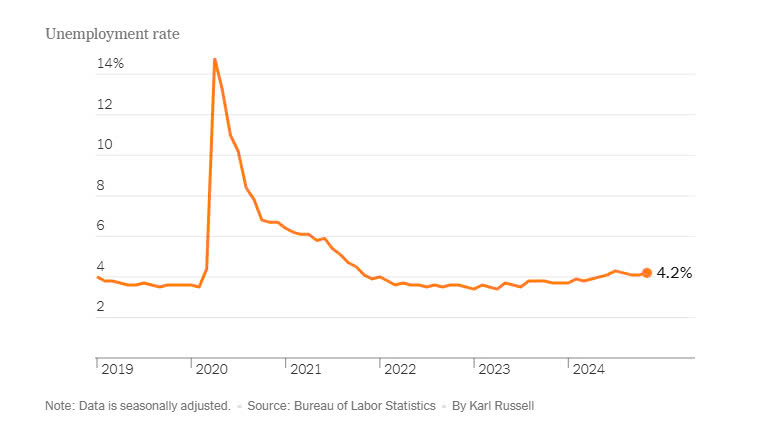

Meanwhile, the unemployment rate edged up to 4.2 percent from October’s 4.1 percent, reflecting more people struggling to find work. However, wages saw a better-than-expected rise, climbing 4 percent compared to a year earlier for those already employed.

“We’re transitioning from an exceptional post-pandemic labor market to a strong, sustainable long-term labor market,” said Gus Faucher, chief economist at PNC Financial Services Group. “While I wouldn’t say we’ve definitively achieved a soft landing, this certainly resembles what one would look like.”

The public outlook appears to be improving, with inflation easing and layoffs remaining minimal. The University of Michigan’s consumer sentiment index reached a seven-month high in its preliminary December reading.

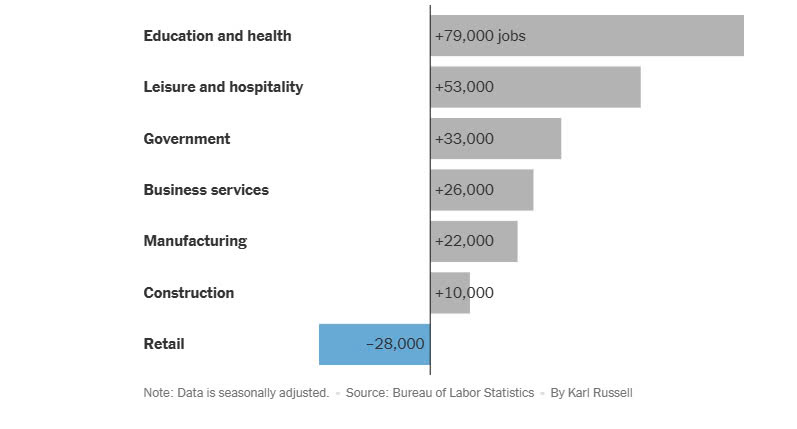

November’s job figures were bolstered by the return of about 37,000 manufacturing workers following the resolution of strikes at Boeing and one of its suppliers. Additionally, recovery efforts in Florida and North Carolina after Hurricanes Helene and Milton likely contributed to the notable gain of 53,000 jobs in the leisure and hospitality sector.

Beyond these factors, the primary driver of job growth was health care and social assistance, supported by structural demand as the U.S. population continues to age. However, manufacturing outside the aerospace industry saw job losses, and the retail sector shed 28,000 positions, likely influenced by weak holiday season hiring and seasonal adjustment effects.

Education and Health Lead Growth

Change in jobs in November 2024, by sector

The report’s tempered tone encouraged investor optimism for a potential Federal Reserve interest rate cut during its meeting in two weeks. However, the future of monetary policy remains uncertain, as the incoming Trump administration’s proposals for tariffs and immigration restrictions could stoke inflation.

Stocks inched higher on Friday, while bond yields dipped slightly.

Economic data reflects a shift from the rapid turnover of the pandemic’s peak to a more measured labor market, characterized by slower job transitions. Workers who frequently switched employers between 2020 and 2022 are now staying in their roles, and businesses are focusing on retaining staff rather than expanding hiring.

This newfound stability may explain recent gains in productivity, as employees grow more adept with longer tenure in their positions. This dynamic allows employers to raise wages without significantly increasing labor costs for consumers.

“Wage increases are steady and persistent, but in a positive way,” said Sarah House, a senior economist at Wells Fargo. “Workers are more productive, which enables businesses to offer higher pay without passing on costs.”

Temporary staffing, a bellwether for labor demand, has declined sharply. Job openings have fallen over the past two years, with temporary staffing services shedding nearly 600,000 positions since peaking in March 2022. Known for its cyclical nature, the sector now sits well below pre-pandemic levels, reflecting more cautious hiring practices.

Timothy Landhuis, vice president of research at Staffing Industry Analysts, attributes the decline in temporary staffing primarily to the struggles in manufacturing, where many temporary roles are concentrated. Both white-collar and blue-collar segments of the industry are facing challenges as employers prioritize keeping their full-time staff engaged.

“It’s fair to call this a temp staffing recession,” Mr. Landhuis noted. “In some cases, H.R. and procurement departments may have overcorrected, setting aggressive goals and cutting too deeply.”

For workers, however, this shift isn’t entirely negative. The persistently low unemployment rate suggests that many individuals who lost temporary jobs may have transitioned to permanent roles instead.

Patrick Industries, a conglomerate producing components for recreational vehicles, boats, and manufactured homes, eliminated its use of temporary workers years ago. While the company experienced a surge in demand during the pandemic, orders have since tapered off due to market saturation and high interest rates, which have discouraged large purchases.

As a result, Patrick Industries had to downsize and reduce entry-level wages, which had surged during the pandemic boom. To retain its remaining workforce, the company has scaled back factory hours, operating about four days a week compared to a peak of six. This trend is reflected across the industry, with the average workweek currently at unusually low levels.

“We’re at a point where we prefer not to lay off,” said Andy Nemeth, CEO of Patrick Industries. “We’re willing to absorb some inefficiency to retain our workforce, ensuring we’re ready to scale up when the cycle shifts.”

The tepid demand for labor might also shed light on the plateau in labor force participation among prime-age workers. While the share of individuals working or seeking work had exceeded expectations—thanks in part to workplace flexibility enabled by videoconferencing and instant messaging—the trend now seems to have stalled. Over the past two months, the labor force has contracted by more than 400,000 people.

“There’s only so much more participation to gain,” said Thomas Simons, a U.S. economist at Jefferies. “For people aged 25 to 55, life circumstances limit how much further participation can rise.”

The stagnant job market is proving challenging for job seekers. While initial unemployment claims remain low, ongoing claims—those continuing to draw unemployment benefits—have been creeping upward. The median duration of unemployment has also risen to 10.5 weeks, compared to nine weeks a year ago.

Chris Catlett is feeling the impact firsthand. Laid off three weeks ago by FedEx in Memphis amid a slowdown in the trucking industry, the senior network engineer with over a decade of experience quickly began his job search. Despite a reasonable severance package, he expects it may take time to secure a new position.

“It’s a highly competitive market due to remote work—employers now have access to a global talent pool,” Mr. Catlett remarked. He’s considering short-term roles to bridge the gap until he finds a suitable full-time position.

“The contract work might not be exactly what I want, but you’ve got to stay active and stay driven,” he added.