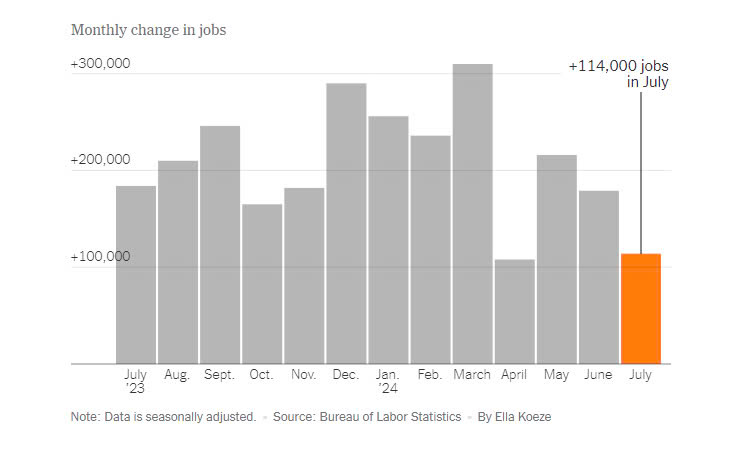

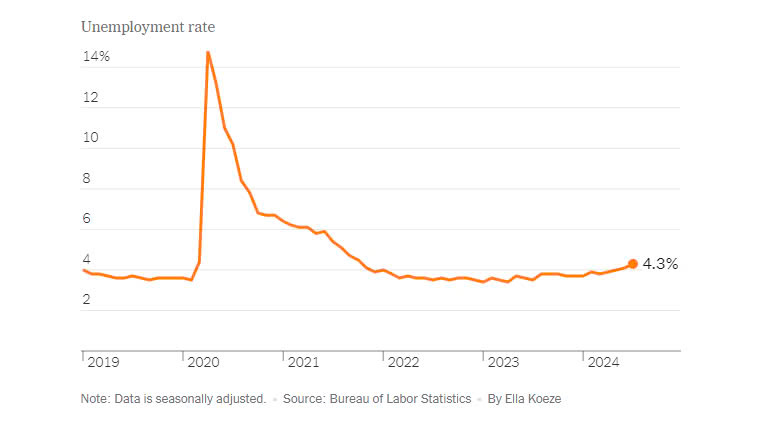

In July, U.S. employers added only 114,000 jobs, falling well below expectations, while the unemployment rate climbed to 4.3 percent, marking its highest point since 2021.

American employers sharply scaled back hiring in July, heightening concerns that the economy may be cooling more rapidly than anticipated.

The Labor Department reported on Friday that payrolls grew by just 114,000 jobs, marking the second smallest increase in a 43-month streak of job growth. Meanwhile, the unemployment rate rose to 4.3 percent, its highest level since October 2021, when pandemic-related fears were still prevalent.

The data has fueled worries that Federal Reserve officials, who have been cautious about cutting interest rates as they await clear signs of inflation subsiding, may have delayed action for too long. This hesitation raises concerns of a potential downward spiral in the labor market. While the Fed maintained the benchmark interest rate at 5.3 percent during this week’s meeting, policymakers hinted that a rate cut might be considered at their mid-September meeting.

“I’m not hitting the panic button just yet,” said Robert Frick, corporate economist at Navy Federal Credit Union. “However, it’s definitely a cause for concern and a clear sign that the Fed is lagging in reducing rates.”

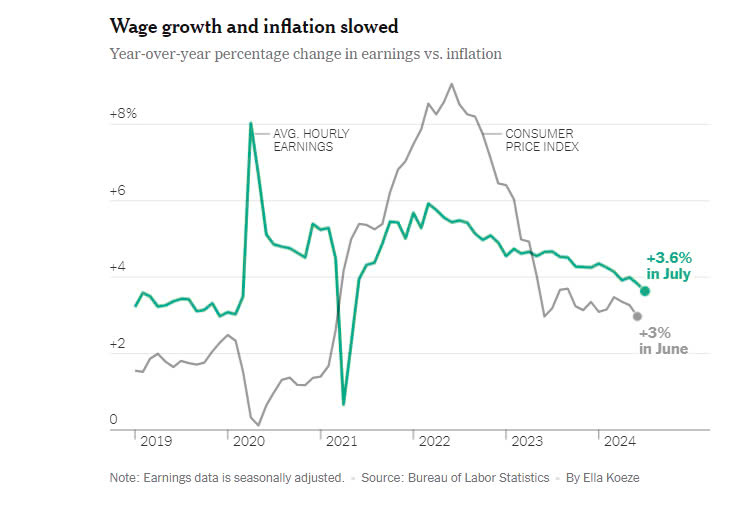

Wage growth slowed in July, with average hourly earnings rising just 0.2 percent from the previous month and 3.6 percent over the past year. Meanwhile, the number of workers in part-time roles who preferred full-time positions increased, and weekly hours worked edged down slightly—both signs of weakening demand for labor.

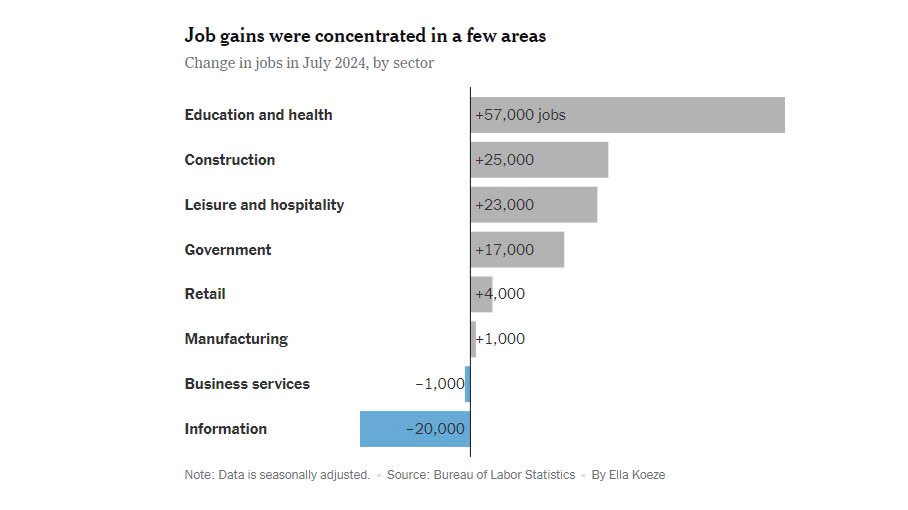

Adding to the report’s lackluster tone, job growth was heavily concentrated in a few sectors, such as health care, social assistance, and construction, which has remained unexpectedly robust despite high interest rates. Government employment continued to contribute to overall job gains, though at a slower pace compared to earlier in the year.

By contrast, many industries showed little to no growth or shed jobs, including the information sector, which cut 20,000 positions.

The private sector added fewer than 100,000 jobs in July, highlighting a notable slowdown in hiring. Additionally, payroll figures for May and June were revised downward by 29,000 jobs, further emphasizing the labor market’s deceleration.

The report, which fell well short of the 175,000 jobs forecast, triggered a sharp market reaction, with the S&P 500 dropping 1.8 percent on Friday. Signs of deeper challenges in the labor market added to a week of economic data pointing to a slowing economy. On Thursday, a key monthly indicator revealed a cooling in manufacturing activity, while a separate labor report on Tuesday showed hiring in June fell to levels last seen at the pandemic’s onset.

In a statement, President Biden framed the slowdown as part of a return to economic normalcy. “Today’s report shows employment is growing more gradually at a time when inflation has declined significantly,” he said.

Despite the more subdued hiring numbers, Friday’s Labor Department report still contained some encouraging elements.

The report noted that Hurricane Beryl, which made landfall in Texas in July, appeared to have minimal impact on overall employment figures. However, some economists suggested that the storm’s effects might become clearer in future revisions to the jobs data.

Encouragingly, the labor force participation rate ticked up slightly to 62.7 percent. Among prime working-age individuals (25 to 54 years old), 84 percent were active in the labor market—the highest level since 2001. For prime-age women, the participation rate matched its record high of 78.1 percent, first reached in May.

Although the unemployment rate rose to 4.3 percent from 4.1 percent the previous month, the increase was largely driven by 400,000 additional people entering the job market and looking for work. Furthermore, a separate report on Tuesday showed that layoffs in June remained at low levels.

“Labor demand is slowing more abruptly than we and the Fed probably expected,” said Kathy Bostjancic, chief economist at Nationwide. However, she noted, it remains uncertain whether this slowdown aligns with a “soft landing” or something more turbulent.

Dave Chapin, president of Willmar Electric, an electrical contractor in Willmar, Minn., offered a more optimistic perspective on the labor market.

Mr. Chapin, whose company focuses on commercial projects, noted that hiring skilled employees in his trade has been a persistent challenge for decades. Higher interest rates have added complexity, as clients delay start dates while securing financing.

Despite these obstacles, business remains brisk in Minnesota and Oklahoma, where his company has another office. Chapin is eager to expand his workforce, aiming to hire 10 more employees to his team of approximately 180. However, staffing shortages have forced difficult decisions. “Just last week, we had to pass on a job in Oklahoma because we didn’t have enough people,” he said. “We could take on more work, but the lack of workers is limiting our growth. We have to turn down opportunities because we can’t handle them.”

This paints a nuanced picture of the labor market. While still relatively strong by historical standards, it shows signs of strain. Job growth in July was significantly below the 12-month average of 215,000, according to the Labor Department. Meanwhile, the unemployment rate has been creeping up over the past year, hinting at potential challenges ahead.

Job openings have fallen significantly in recent months, with the ratio of openings to unemployed workers dropping to 1.2 from a peak of 2-to-1 in March 2022. Workers are also quitting less often, reflecting waning confidence in finding better-paying opportunities.

“It’s like in Super Mario Brothers when you grab the star and zoom through everything — that’s what the labor market felt like over the past two years,” said Nick Bunker, an economist at job site Indeed. “But that invincibility has worn off.”

Jennifer Gipfert, owner and CEO of TWC Management, which operates hotels in Colorado, Wyoming, Missouri, and Iowa, said labor shortages that began during the pandemic continue to plague her business. “I don’t think I have one property that can say they’re fully staffed,” she noted.

Across her portfolio, which primarily includes limited-service Best Western hotels, there are 15 job openings. However, applicants often fail to attend interviews, and turnover remains high.

Recently, Gipfert has had to lower room rates as she observes growing consumer hesitation to spend—a sign that could foreshadow a broader economic slowdown in the near future.

“People are being more mindful about their spending,” she explained. “Guests aren’t as willing to pay the rates they did during the height of the travel frenzy.”