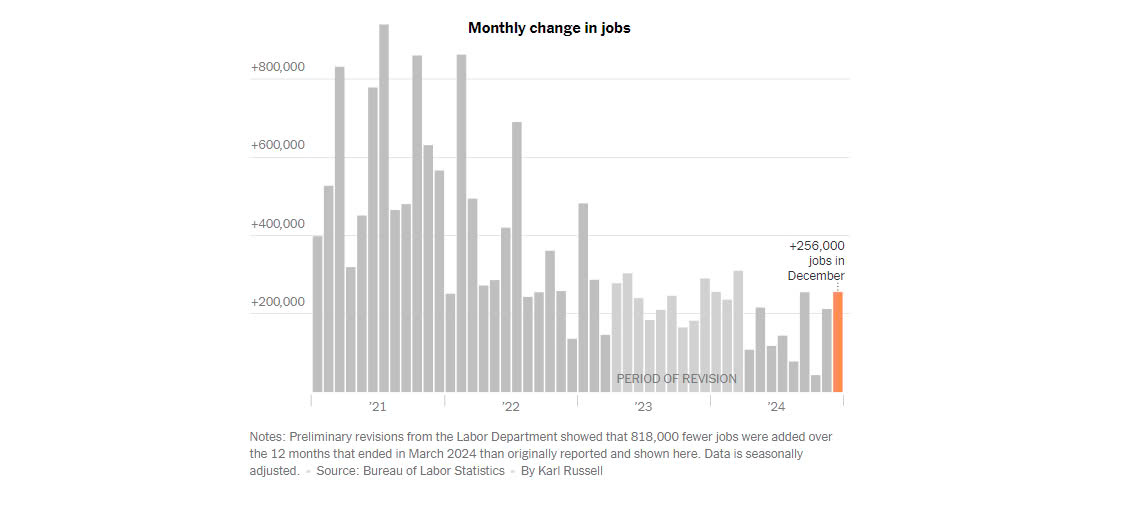

In December, a surge of 256,000 jobs surpassed expectations, bringing unemployment down to 4.2 percent. However, markets reacted negatively as hopes for interest rate cuts appeared more remote.

Employers wrapped up 2024 on a high note, capping the year with a hiring surge after a summer slowdown and an autumn marked by disruptions.

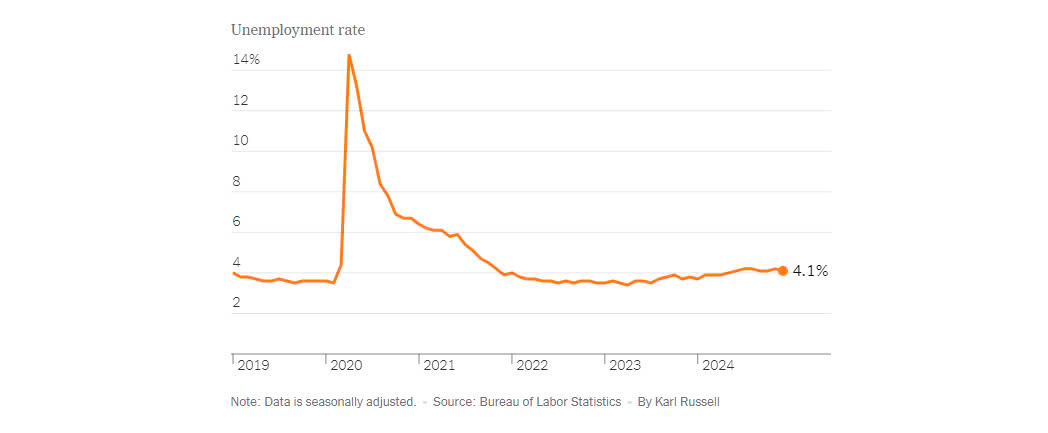

In December, the economy gained 256,000 jobs, seasonally adjusted, according to the Labor Department’s report on Friday. This figure far exceeded expectations, following two years of labor market cooling. Meanwhile, the unemployment rate dipped to 4.1 percent, a historically strong level.

The impressive results—free from the impact of earlier labor strikes and severe storms—may reflect renewed momentum among workers and businesses. Average hourly earnings increased by 0.3 percent compared to November, translating to a 3.9 percent rise over the year, outpacing inflation.

“This employment report blows away all expectations,” noted Scott Anderson, chief U.S. economist at BMO Capital Markets. “It effectively erases the payroll slump we saw from June to August before the significant Fed rate cut in September.”

The apparent rebound in employment growth has dimmed hopes for further interest rate cuts in the near term. Investors widely anticipate that Federal Reserve officials will maintain current rates at their meeting later this month. For policymakers, the strong job numbers highlight a risk: additional monetary easing could reignite inflationary pressures and hinder progress on controlling prices.

“The Fed’s stance is essentially, ‘We believe this is a healthy labor market, and we want to preserve that stability without letting it cool further,’” explained Guy Berger, director of economic research at the Burning Glass Institute. “What they’re not signaling is a desire to actively stimulate the labor market again.”

The robust employment figures triggered a sharp decline in stock markets, while bond yields climbed higher, reflecting expectations that interest rates will remain elevated for an extended period.

Despite market jitters, the data is encouraging for workers. Job openings have returned to pre-pandemic norms, and December’s report further cements President Biden’s economic legacy, with an average of 355,000 jobs added per month during his tenure. (This figure is expected to see slight downward revisions when updated data becomes available next month.)

“This report is the culmination of an extraordinary period of job creation on our watch,” Jared Bernstein, chair of the Council of Economic Advisers, stated in an email. “For this president, achieving and maintaining full employment has been a guiding principle.”

This marks the conclusion of one of the strongest economies to welcome an incoming president in modern history. Consumers continue to spend with confidence as inflation has eased, and layoffs remain at historically low levels.

However, some of President-elect Donald J. Trump’s proposed policies — such as raising tariffs and restricting immigration — could temper job growth in the years ahead. On the other hand, businesses are optimistic that tax cuts and deregulation may boost economic momentum in the opposite direction.

“For the new administration, the critical question is, ‘How do you ensure this strong economic foundation isn’t weakened?’” said Philipp Carlsson-Szlezak, chief economist at the Boston Consulting Group. “It’s a significant inheritance to begin a presidency with.”

The report’s finer points offered further optimism. The drop in the unemployment rate was driven by more people securing jobs, rather than fewer individuals actively seeking work. Additionally, a broader measure of unemployme —which accounts for part-time workers hoping for full-time roles and those marginally connected to the labor forc —has stabilized after peaking at 7.8 percent last summer.

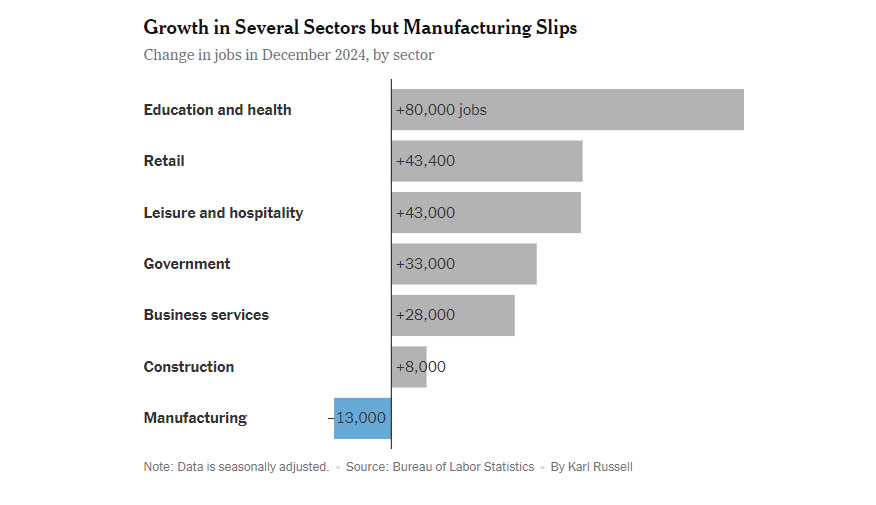

Job growth remains concentrated in the services sector, with health care, social assistance, and leisure and hospitality driving the majority of gains. Government employment also continued to expand across all levels, despite worries that the depletion of pandemic-era stimulus funds might strain state and local budgets.

Retail, which had a stagnant year overall, made a notable recovery by adding 43,000 jobs in December. Meanwhile, temporary help services have seen two consecutive months of job growth following a steep decline, potentially signaling that employers are turning to contingent labor to manage spikes in demand.

Karin Kimbrough, LinkedIn’s chief economist, believes the recent labor market turnaround reflects a shift in employers’ mindset after two years of inflation concerns and pandemic-era hiring adjustments.

“You can’t stay in a perpetual state of caution,” Dr. Kimbrough said. “Eventually, businesses need to step forward, make investments, and ideally create a more dynamic labor market.”

Tristan Hamberg, who has run a painting business in Portland, Oregon, for over a decade, echoes that sentiment. Since the pandemic, he has faced hiring challenges—wages for painters surged by about 40%—and rising material costs. Population loss in Portland eroded his residential client base, while commercial projects dwindled.

“The job market was so uncertain and competitive,” Mr. Hamberg recalled.

Now, his outlook has improved. With a steady crew of four full-time and four part-time employees, he feels optimistic heading into 2025. This renewed confidence is mirrored by a rise in small business sentiment, as measured by the National Federation of Independent Business. Hamberg credits part of his optimism to expectations that the Trump administration might create a more favorable environment for small businesses.

“We’re entering 2025 with strong optimism, a solid budget, and a well-thought-out plan for sustainable growth and profitability,” Mr. Hamberg said.

Adding to employers’ sense of security is the prospect of slower wage growth. A survey by payroll processor Gusto shows small business clients expect wage pressures to ease, helping them better manage costs. However, slower wage growth may have unintended consequences. Potential workers might remain inactive if the financial incentive to re-enter the labor force diminishes. In fact, the labor force participation rate for people aged 25 to 54 has dipped to 83.4%, down from 83.9% earlier in the year.

For those unemployed, finding work can feel increasingly challenging. The average length of unemployment has been climbing since summer, and with fewer workers quitting for better opportunities, openings have become scarcer. Recruiters, often the first to see labor market changes, are not yet seeing significant improvements.

One such recruiter, 31-year-old Christian Carver in North Carolina, has been job-hunting since her layoff in November from Advance Auto Parts, where her entire team was let go. Complicating her search is her pregnancy—her fourth child is due this spring—making in-office roles unfeasible. Yet, remote opportunities have become harder to find compared to two years ago.

“Remote work was so easy to secure a couple of years ago,” Ms. Carver said. “Now, everyone wants hybrid or in-office roles. I’m praying for a miracle and grateful for this time to focus on my family while continuing my search.”

Source: https://www.nytimes.com/2025/01/10/business/economy/jobs-report-december.html?searchResultPosition=1